The Ultimate Guide to Navigating Property Insurance Claims in Illinois

A practical guide to filing claims and getting your property restored

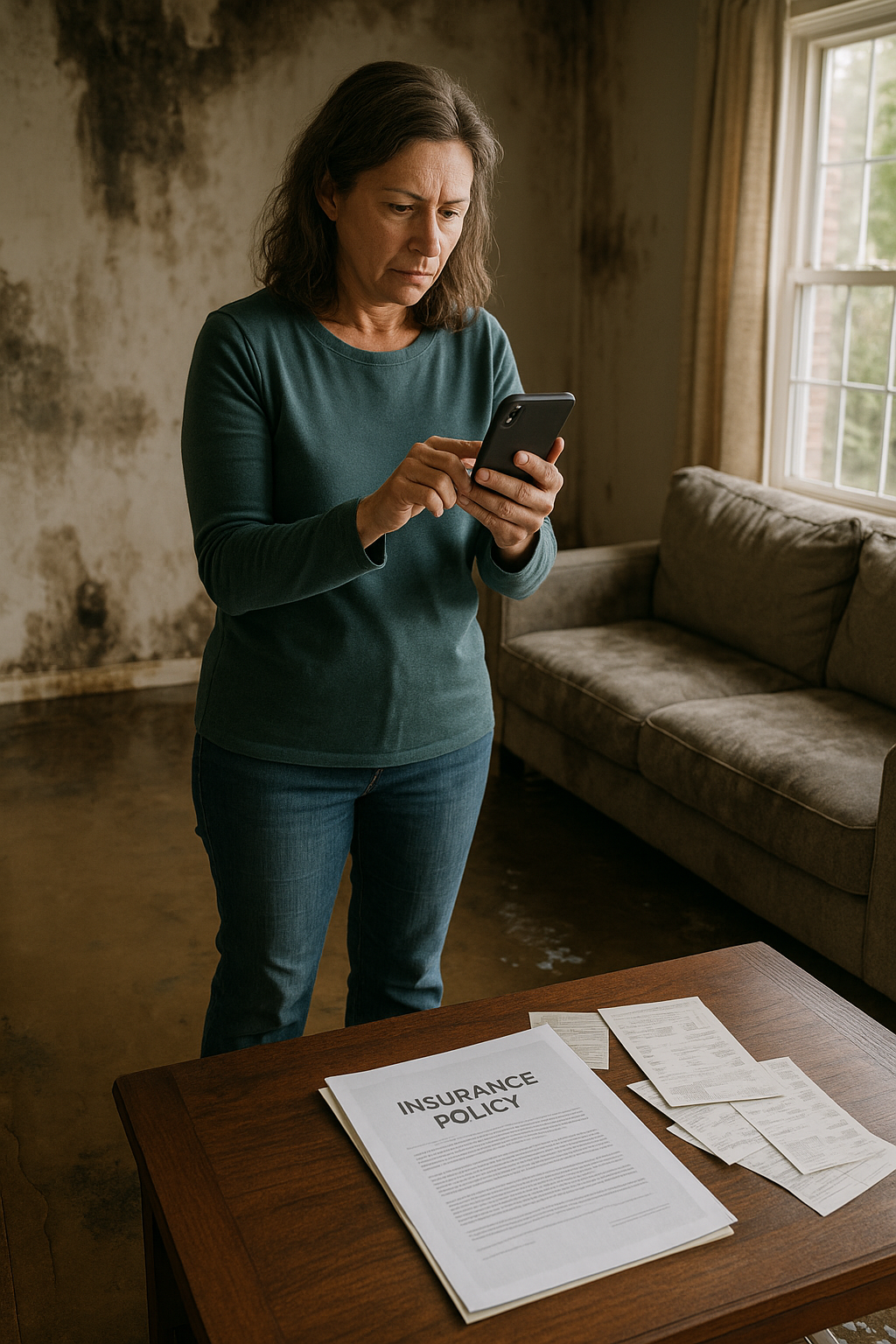

Disaster is never convenient. It always seems to hit when you are least prepared, leaving behind a mess, a headache, and a lot of questions. Whether it is a flooded basement after heavy rain, a kitchen fire that leaves your house full of smoke and water, or a summer storm that sends a tree through your roof, most homeowners and business owners in Illinois find themselves in the same boat: wondering what comes next and hoping insurance will come through.

But for anyone who has ever filed a property claim, you know the process is not as simple as calling your agent and waiting for a check. The truth is, navigating a property insurance claim can feel like trying to read a contract in a language you barely understand. There are deadlines, rules, paperwork, and sometimes a maze of people, adjusters, agents, contractors, even your mortgage company, all with different roles and priorities.

If you want to protect your property, your peace of mind, and your wallet, you need to know how the process really works. That is what this guide is here for: a practical, straight-talking overview of what to expect, what pitfalls to watch for, and how to come out the other side with your sanity intact.

Filing Your Claim and Understanding Your Coverage

Filing Your Claim: It Starts Before Disaster Strikes

It sounds obvious, but the first and best thing you can do happens before you ever have a claim: know your policy. Too many people only look at their coverage after something goes wrong, only to find out what is not covered when it is too late. Take time to review your insurance with your agent each year. Ask about common exclusions, endorsements for things like sewer backup or mold, and whether your policy pays actual cash value or full replacement cost. It is also smart to take photos of your property and valuables, and store those along with receipts for any major upgrades or purchases. When the time comes, you will be glad you did.

If disaster does strike, documenting everything is your first step. Take clear photos and videos of all the damage before you move a single item. Make a list of everything affected, and keep receipts for anything you buy to prevent further damage or for temporary living arrangements. Promptly contact your insurance company and open a claim. The sooner you start, the sooner you are on your way to recovery.

Understanding What Is Covered (and What Is Not)

Insurance policies are not all the same, and what is covered in one state or with one company might not be covered with another. Most standard policies will help with sudden and accidental damage from fire, water, storms, or theft. But there are always caveats. Flooding from outside water usually requires a separate flood policy. Mold, slow leaks, and wear and tear are often excluded unless you have specific endorsements. Even things like hail and wind damage can be limited depending on your policy. Replacement cost coverage is ideal because it pays for new items, not just the depreciated value, but not everyone chooses this due to the extra premium. Know the details of your policy so there are no ugly surprises.

The People and Steps Involved in Your Claim

The Roles of Adjusters, Agents, and the Restoration Company

Once your claim is open, the insurance company will send an adjuster to inspect the damage. Remember, the adjuster works for the insurance company, not for you. It is up to you to be your own advocate. Your agent can be a powerful ally, especially if the process gets bogged down or if you feel you are not getting the attention your claim deserves. If you are not satisfied with the adjuster’s findings, do not be afraid to ask questions or request a second opinion.

This is where a professional restoration company can make all the difference. The best restoration teams know how to work with insurance, document damage correctly, and keep the process moving. They understand the local codes, the expectations of Illinois insurers, and they have the right tools to uncover hidden water, smoke, or mold damage that an adjuster might overlook. If there is disagreement about the extent of repairs, the appraisal clause in your policy allows both sides to bring in their own experts, with a neutral umpire to settle things if needed. Sometimes just mentioning appraisal will encourage the insurance company to come to the table.

Mortgage Companies, Checks, and Who Gets Paid

One headache many owners do not expect is the involvement of their mortgage company. If you have a mortgage, the lender will likely be named on any insurance check over a certain amount. The idea is to make sure the money is spent on repairs and not on something else. This usually means sending in repair estimates, allowing inspections, and waiting for the lender to release funds in stages. It is frustrating, but it is designed to protect everyone’s investment in the property.

Protecting Yourself and Navigating Roadblocks

Your Rights and How to Stand Up for Them

Illinois law gives policyholders a set of rights, including fair treatment, prompt communication, and a thorough investigation. If you feel your insurance company is delaying, underpaying, or denying your claim without proper explanation, document every interaction. Keep a log of calls, emails, and in-person meetings. If you hit a wall, contact the Illinois Department of Insurance. They investigate complaints and can sometimes move the process forward just by getting involved.

It is also worth noting that if your insurer is acting in bad faith, ignoring deadlines, refusing to explain denials, or offering obviously unfair settlements, you have legal remedies. Sometimes just showing that you know your rights is enough to get things moving again.

Common Exclusions, Endorsements, and Why Reviews Matter

Policies are full of fine print. Typical exclusions include flooding, earth movement, long-term leaks, and sometimes even things like frozen pipes if you did not maintain heat in the winter. Endorsements are add-ons you pay for to cover risks like backup of sewers or drains, high-value jewelry, or even business interruption for commercial policies. If you do not have these, you will not be covered. That is why an annual insurance review is not just a box to check, it is a real opportunity to fill in coverage gaps before disaster finds you.

What to Do When Things Get Complicated

Sometimes, even when you do everything right, a claim gets denied or bogged down. Maybe the adjuster missed hidden damage, or there is disagreement over repair costs. If that happens, you can bring in a public adjuster who works for you, not the insurer, or invoke the appraisal process to get a fair resolution. If you are dealing with lost business income, keep detailed records of your losses and extra expenses. Business interruption coverage, if you have it, can be a lifesaver, but only if you document everything.

And if the whole process feels overwhelming, remember: help is out there. Restoration professionals, public adjusters, and your agent are all resources. So is the Illinois Department of Insurance.

Special Challenges and Avoiding Delays

The Special Challenges of Different Types of Claims

Water, fire, wind, hail, and mold each bring unique headaches. Water damage needs quick action to prevent mold and rot. Fire damage is as much about smoke and soot as burned material. Wind and hail can leave invisible structural problems that are easy to miss. Each situation has its own process and deadlines. The best restoration companies know how to handle all of them and can help you avoid common mistakes that cost you time and money.

Keeping Good Records and Speeding Up Payment

Want your claim to get paid quickly? Stay organized. Keep every receipt, take notes on every phone call, save every email. Take photos before and after repairs, and always get written estimates and contracts. If you are ever audited or questioned by the insurer, you will have everything you need.

Final Thoughts

No one likes thinking about disaster until it is staring them in the face. But the truth is, just a little preparation, knowing your policy, documenting your property, and having the right contacts, can make a huge difference in how your recovery goes.

When disaster strikes, you will be glad you did the work up front. If you need help, do not be afraid to ask. The right restoration team can guide you, protect your interests, and get your life or business back on track.

This guide is your starting point. In the coming weeks, we will dive deeper into every section, so you have the knowledge you need, no matter what happens next. If you are reading this after damage, take a breath. You are not alone, and with the right support, you can get through it.